A Law Society of B.C. tribunal has found Vancouver lawyer Daniel James Barker guilty of professional misconduct for failing to be on guard against being a dupe for what it called a “notorious” fraudster.

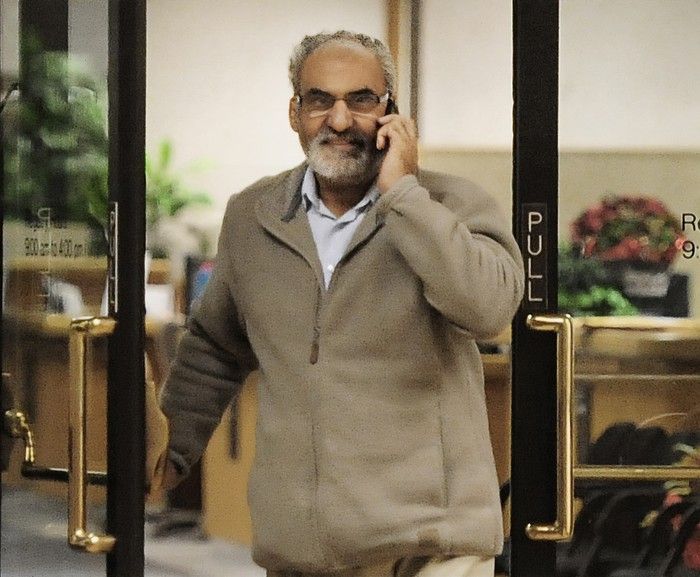

That would be Tarsem Gill, who was accused in 2008 of masterminding one of B.C.’s largest real-estate frauds. He faces charges that have still not gone to trial.

The tribunal also found that Barker had failed to make reasonable inquiries into “suspicious circumstances.”

Those included determining whether Gill may have been a beneficiary in real estate transactions with others acting as proxies, verifying where money for the deals came from and where it was going, examining the use of numbered companies and determining why mortgages were being added to properties that were already facing foreclosure.

Barker’s dealings with Gill took place between 2018 and 2019.

“After considering all the evidence and submissions, the panel finds that the respondent’s conduct was contrary to the code and amounts to a marked departure from conduct expected of lawyers and thus, constitutes professional misconduct,” the tribunal wrote in its 85-page ruling.

No appeal has been filed or is being contemplated on the ruling, said lawyer William Smart, who represented Barker. Smart said Wednesday that Barker has retired from the practice of law, which he did before the tribunal decision for reasons unrelated to the hearing.

A decision on disciplinary action, which sets a penalty, is scheduled for May 22, according to the Law Society of B.C.

The tribunal noted that as part of a lawyer’s duty to be on guard against being a dupe or facilitating an unscrupulous client’s unlawful activities, the lawyer must be alert to suspicious circumstances known as red flags.

In this case, there were several red flags, said the tribunal.

The red flags included that Gill, as a “notorious” alleged fraudster, was involved in the transactions.

Gill is only identified as AB in the tribunal’s decision, but there are specific details about previous case history to confirm that AB is Gill.

The tribunal noted that Barker became aware that Gill faced fraud charges related to allegations he scammed nearly $40 million from 77 homebuyers and 30 lenders in a complicated pyramid scheme.

The lawyer involved in that scheme, Martin Warwick, pleaded guilty in 2009 for his part in the fraudulent real estate transactions between 1999 and 2002 and was sentenced to seven years in jail. Warwick was also disbarred.

The tribunal noted that Barker also became aware that Gill was an undischarged bankrupt and that a B.C. Supreme Court judge issued a default judgment in 2017 against Gill and Rajinderjit Bhela, and ordered them to pay $500,000 in damages to The Toronto-Dominion Bank for a cheque-kiting scheme. Bhela was one of Barker’s clients involved with Gill.

Cheque-kiting is a fraudulent practice where time delays in cheque clearing is used to inflate an account balance and write cheques for more than the funds available.

The tribunal said other red flags included that Gill was the point person for files involving clients, when there is no evidence of any instructions by the clients that Gill worked on their behalf.

During the tribunal proceedings, Barker denied any professional misconduct and said he was not required to make reasonable inquiries in the circumstances. He argued that similar to criminal defence lawyers, civil litigation defence lawyers should not be required to ask their clients any questions as to whether they are guilty of crimes, dishonesty or fraud.

Barker also argued that alleged “notorious” fraudsters have the right to hire lawyers to defend themselves regardless of guilt or innocence.

The tribunal noted that in order for Barker to fulfil his gatekeeper function, whether Gill was a “notorious” alleged fraudster or not, he was required to identify and verify the source of funds with his clients before they were deposited into his trust account. The tribunal noted that in one instance, $100,000 was deposited in Barker’s trust account before he retained any client and he provided no legal advice in connection with the money.

“The point is that the respondent did not need to know whether (Gill) or his clients were in fact involved in something unscrupulous. He just needed to reduce the risk that he was providing misleading information to the court or facilitating illegal activity by making reasonable inquiries,” said the tribunal.

Barker is not the only lawyer to be sanctioned in the past several years for his dealings with Gill.

Paul De Lange surrendered his law licence in late 2022 after a misconduct investigation. He admitted to the Law Society of B.C. that between 2015 and 2018, he allowed 65 transactions involving Gill and his associates to pass through his trust account, receiving $21 million and disbursing $1.6 million.