Prime Minister Mark Carney has signed a landmark agreement with China to significantly reduce tariffs on Chinese electric vehicles in exchange for China dropping duties on Canadian agricultural products.

The deal will allow China to export up to 49,000 Chinese electric vehicles per year into Canada at a reduced tariff of 6.1 per cent, down from the 100 per cent imposed in 2024 in tandem with the U.S.

Now that barriers to Chinese imports have been reduced, what does it mean for B.C.’s appetite for EVs?

B.C. and Quebec have led the way in electric vehicle adoption in Canada, so there is likely to be interest in Chinese-made vehicles here, particularly if they can be delivered at a lower price than other electric vehicles, say industry observers.

The Carney government has said that with the agreement it’s anticipated that in five years more than half of the Chinese electric vehicles will be affordable, with an import price of less than $35,000. The least expensive Tesla, by contrast, can be bought in B.C. for $55,000 to $60,000.

BYD, a major electric vehicle manufacturer in China , has a short-range model that is sold in Europe, starting at around Cdn$35,000.

“I’m hearing the Chinese cars are interesting. They’re cheaper,” says Bob Porter, president of the Vancouver Electric Vehicle Association. “We’ve got a couple of people I’ve talked to here that have driven them in China or in Europe, and they said they really like them.”

How soon will Chinese-made vehicles be available?

Electric vehicles from Chinese companies will not be arriving immediately.

Chinese imported vehicles have been coming from companies like Tesla and Volvo, which manufacture some of their vehicles in China.

When Canada imposed 100 per cent duties on Chinese electric vehicles, Tesla and Volvo simply shifted where they shipped the vehicles from, Europe for Volvo, and the U.S. for Tesla, say industry observers.

Werner Antweiler, an associate professor with the Sauder School of Business at the University of B.C., said the first thing that will happen is there will be a “reshuffling” and those vehicles will likely once again be shipped from China.

In the medium term, Chinese companies such as BYD, XPENG and Great Wall Motors may enter Canada, but they will struggle at first to set up a distribution network, said Antweiler, whose expertise is in international trade policy.

“For many buyers, after-sales service for repairs and parts is important, and building up this network will take time, and considerable effort,” he said. “I call this the brand-building phase.”

But Antweiler noted that BYD and GWM have successfully entered other markets, even with countervailing duties, for example, in Europe.

Will the Chinese cars be compatible with our charging stations?

Porter said there is a move to standardize charging ports in North America.

And there is an expectation that Chinese imports to Canada will be outfitted with chargers compatible here.

Porter noted that Chinese-made electric vehicles are sold all over the world.

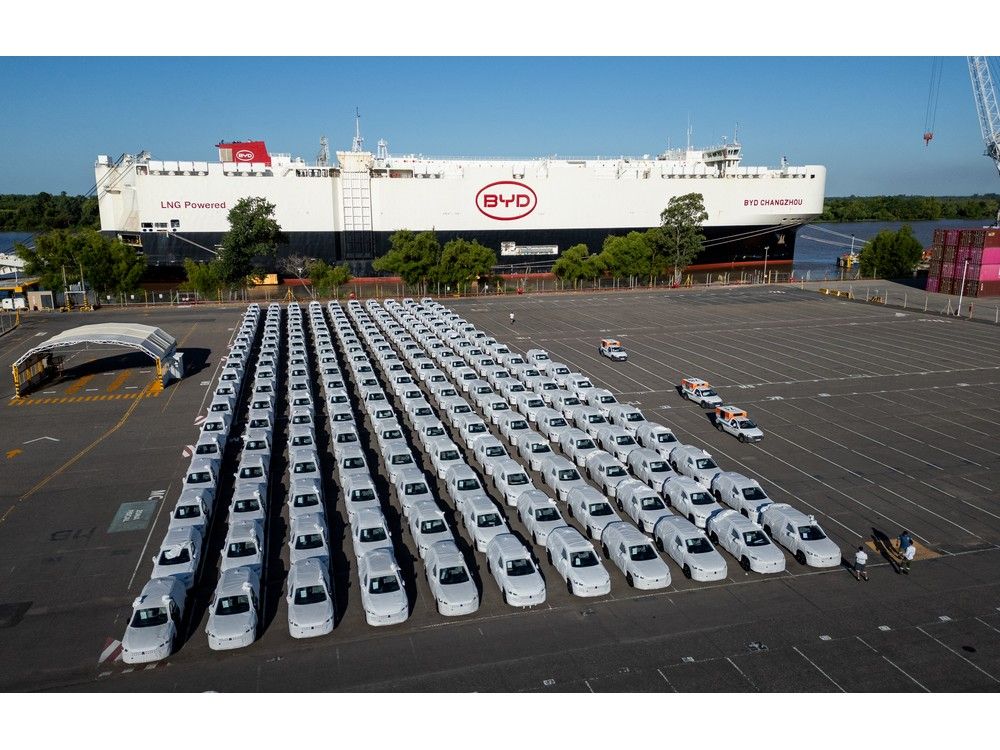

BYD, for example, sells its vehicles in South America, Africa, Southeast Asia, Europe, the Middle East and Australia.

Will they stand up in cold weather?

According to sub-zero tests of 67 electric vehicles in China in 2025 , the Chinese-made electric vehicles stood up well, although all vehicles lost range. Chinese vehicles were in the top 10, along with Tesla and Nissan.

Will the electric vehicles be made in Canada eventually — and does B.C. benefit?

Carney hinted at manufacturing in the future in Canada, saying it’s expected that within three years the agreement will drive considerable new Chinese joint-venture investment in Canada to protect and create new auto manufacturing careers for Canadian workers.

Antweiler says that in the long-term Chinese companies may consider setting up production in Canada to overcome the barriers from the tariff quota.

However, he noted that Canada’s market is small, and a large investment will likely only pay off if there is also access to the U.S. market through Canada. If that pathway is blocked by U.S. tariffs, he said he didn’t see much interest from Chinese companies investing in production capacity in Canada.

Porter noted that because Canada’s vehicle manufacturing sector is in Ontario, even if Chinese cars or parts are manufactured in the country, it isn’t likely to benefit B.C.