There’s a lot of monopoly-related news, as usual. The NASCAR antitrust case settled, the Netflix-Warner-Paramount drama continues with a hostile takeover attempt, Texas Attorney General Ken Paxton sued the “big tech” of electronic health records, and the beef packers oligopoly shutdown another major plant just before Christmas.

But I want to focus on two news events this week involving the Federal Reserve, the most important price control agency in the world. One got a lot of press, the other didn’t. But taken together, we can see the outlines of a very different way money will work in America. I don’t know when the political establishment is going to wake up to these shifts, but one day they will.

The first piece of news is that on Monday, the Supreme Court heard Trump vs Slaughter, a case on the authority of the President to fire independent commissioners of regulatory agencies. For legal and political people, this case is about how much direct power the President should have over the regulatory state. But conservatives jurists are likely to carve out an odd exception for the Federal Reserve, the most powerful agency in our regulatory state. Trump will be able to fire any political official anywhere in the executive branch, except for those at the Fed. That’s… weird.

Why? The stated reason, as Justice Alito once wrote, is that the Fed is not a normal part of government, it “should be regarded as a special arrangement sanctioned by history,” as it is a “unique institution with a unique historical background.” This rationale makes no sense; every regulatory agency is unique and and arose due to special historical circumstance. But of course, everyone knows the court has to organize its decision in a laughable inconsistent manner because it can’t say the real reason. And that is that the court is protecting our real constitutional order, which is one in which Wall Street and the Federal Reserve structure our society.

That’s a bold claim, so here’s what I mean. The day after the court heard the Slaughter case, Fed Chair Jay Powell quietly announced that the Fed would once again begin buying forty billion dollars worth of bonds a month, with jargon about enhanced liquidity and reserves and other words meant to confuse ordinary people. That’s $125 per American per month, pushed into the bond market, yet the announcement barely made a ripple. Powell also radically expanded another program which will allow hedge funds to bank more easily at the Fed. There were no outraged hearings in Congress, Trump offered no comments, and it generated no newspaper headlines.

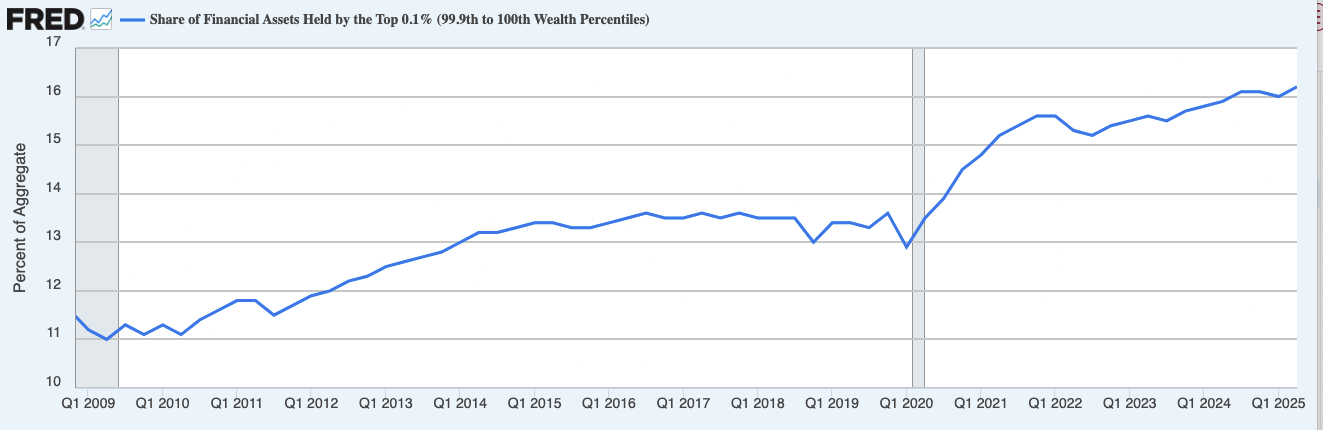

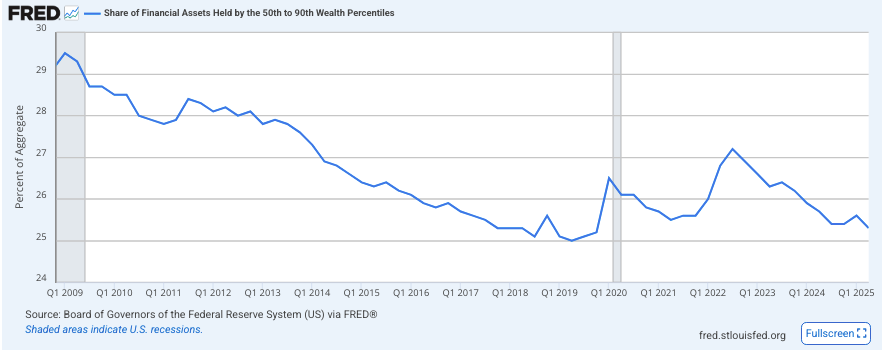

More broadly, every time there are problems in financial markets, the Fed rushes to the rescue as an extremely effective government for the superrich. Indeed, in the 15 years after 2008, the Federal Reserve bought seven trillion dollars of bonds, corporate assets, and mortgage backed securities, seeking to lift the value of stocks, bonds, and houses. The Fed told itself a story that it was just trying to help the economy; the “wealth effect” filtered down to more consumer spending, and a “portfolio effect” led to people buying riskier assets, which would lead to more investment. Whether these were good or bad changes is besides the point, the goal was to maintain a high equity market. And while the Fed did succeed in preserving elevated stock values, it also helped foster a far more unequal and far angrier America.

The share of wealth held by the top 0.1% since 2008 versus any other cohort tells the story.

There are many other ways to tell it as well. For example, take this 2007 headline:

Oops.

Anyway, the days of political placidity for the Fed are numbered, because its role in our society is just too important to be ignored. Donald Trump, unlike previous Presidents, understands that the Fed is politically weak, and because of that, it is malleable. And in the next few years, he will transform the Fed in ways that will make it unrecognizable.

This dispute is often framed as one over ‘Federal Reserve independence.’ The term “independence” means that the Fed remains predictable in its operations and goal of keeping the stock market up, while free from the direct influence of elected officials. Trump is seeking the direct ability to fire Fed officials, and he’s likely to lose that battle. But importantly, he’s also attacking the institutional basis for Fed independence, the thousands of staffers whose habits comprise that predictability, and who constantly frustrate the aims of the politically appointed officials that seek to make any meaningful changes. And in that, he’s likely to accomplish a great deal. It’s not that he is going to improve the Fed, but good or bad, the central bank will soon operate differently.

Here are some of the historic shifts happening at the Fed, which are going to reorder the institution:

New Vice Chair for Supervision, Michelle W. Bowman, is cutting 30% of the staff of the Division of Supervision and Regulation. Many of these people have been there for decades, which means there’s a huge loss of institutional knowledge and habit. There will be new people coming in.

Trump will soon be picking a new Federal Reserve Chair, who will likely have less interest in maintaining the institutional precedents that serve to block out political influence over the Fed. Since Treasury Secretary Scott Bessent has already bought into reforming the institution, it means that we might actually get reform. An aligned Treasury Secretary and Fed Chair can defeat the “blob” of bureaucrats who want to maintain the status quo.

Bessent’s essay, “The Fed’s New Gain-of-Function Monetary Policy,” is important. His view is that the Fed’s actions since the financial crisis have been far outside the bounds of traditional monetary policy and have served to accelerate an upward transfer of wealth in America. He seeks to strip the Fed of authority.For the first time, Federal Reserve board governors, the actual political appointees, are able to bring in external political staff to help execute their agenda. Traditionally, individual Fed governors had almost no power. Over the past few decades, the practice has been to internally rotate career staff to serve as advisors to the governors. They were blocked from bringing in people from the outside and that helped ensure the blob would crush governors who wanted to get even small things done. New Trump Fed governor Stephen Miran bulldozed through this practice and hired his own advisors.

Trump is likely seeking to change how the Reserve bank Presidents are picked. The Fed board just sought to short-circuit that move by reappointing 11 reserve bank Presidents before their terms are up. It won’t matter, when Trump has a majority, he has the legal authority to remove them.

A President like Trump has never had such influence over the Federal Reserve’s authorities. The Fed’s balance sheet right now is a little over $6 trillion, and Trump may soon get to dole out who gets bailouts and access to a whole series of benefits. The opportunities for corruption are ripe; Trump could hand out master accounts with the Fed to friends, have the Fed buy financial instruments of his allies, offer emergency loans, and so forth. There’s a lot of mischief in an unlimited balance sheet, and we’re all going to be confronted with it. In other words, in 2029, the next President will face a very different Federal Reserve, one run largely by Trump officials who have reordered the role of the central bank.

To understand why these changes matter, we have to dispense with the central lie in our monetary system, which is that banks are “private” institutions. They aren’t. Every “private” bank, which includes quasi-banks like hedge funds, is part of the Federal government, awarded a franchise to manage the full faith and credit of the United States. The Fed is the broad franchisor of this system, tasked with organizing it and providing a regulatory umbrella and backstop.

That’s why Silicon Valley Bank got immediately bailed out, because it’s a core part of the sovereign’s job to protect the public’s use of money. To put it differently, J.P. Morgan CEO Jamie Dimon is a government bureaucrat running a franchise of the Federal Reserve, he’s just a particularly highly paid one.

It’s a jarring thing to claim that banks are all part of the government. This notion is outside our way of understanding political economy, except during “emergencies” when bailouts become necessary to address a “crisis.” Preserving the fiction that banks are private requires a language so dishonest that the world of money chatter is split into a class of people who mumble in jargon-heavy tones, and a class of people who sound like conspiratorial nutcases. It also perverts the operations of the Fed.

The Fed has two broad tasks, to have stable prices and maintain full employment. To accomplish these tasks, it sets borrowing rates across the economy with its multi-trillion dollar balance sheet, choosing who has direct and indirect access to that balance sheet, and it supervises banks and financial institutions with examiners. In order to manage prices and employment, the Fed offers money to a small set of banks and hedge funds, in the hopes that those financial institutions then lend that money out to the rest of us through credit cards, commercial loans, and mortgages in ways that will make the economy do what the Fed wants.

But instead of the Fed just accepting that it controls the money supply, it has to preserve the fiction that there is some sort of private sector. So instead of just setting rates directly, it manipulates what’s called the “Federal funds market,” which is where banks used to borrow and lend to each other as a way of setting the price of money. When banks set credit card rates, mortgages, commercial loans, and whatnot, they reference the Federal funds rate to set the price of the loan.

For a variety of reasons, the Federal funds market has changed. It is largely where foreign banks come to borrow from a different set of Federal government agencies, called the Federal Home Loan Banks. There are technical reasons the Federal funds market is so screwed up, but they are besides the point. The whole thing exists so the Fed can pretend it’s not in charge. In addition, the Fed, in 2008, got the authority to pay banks directly when they deposit money at the Fed, something called “interest on excess reserves.” 10% of our entire Federal deficit is now made up of such payments, most of which went to big Wall Street banks and foreigners. JPMorgan Chase, for instance, received $15B in such payments in 2024, more than its investment banking division. This kind of payment from the Fed to fellow government institution JP Morgan necessarily means that less credit will flow to normal people.

To that end, let’s go back to the two jargon heavy changes announced this week. The first is that the Fed is going to buy $40 billion of Treasury bills every month, meaning that big banks will have a lot more cash on hand to push up asset values. The second is that it is expanding the ability of hedge funds to get extra payments through something called “overnight repurchase agreement (repo) operations.”

The presumed problem the Fed is trying to address is a lack of “liquidity” by financial actors. Liquidity means having lots of willing buyers and sellers for something. If you’re a hedge fund, and you can’t sell in a market with lots of willing buyers, you may have to take a loss. That means people lending to you are going to be worried, so they’ll charge more to borrow. The Fed, since it wants to keep rates at a certain level, feels it is losing control of borrowing rates it is trying to manipulate. So it seeks to keep hedge funds and big banks happy by giving them extra benefits, which will keep borrowing rates for those guys down.

In other words, both announcements are attempts by the Fed to manipulate money markets so that Wall Street entities get access to cheaper credit, while smaller banks who lend to small businesses, farms, and manufacturing firms are starved.

Of course, there’s no actual reason the Fed has to operate solely through a small network of big banks, foreign banks, and hedge funds. It could just let everyone in America have access to a Federal Reserve bank account. If it needed to target credit for a specific sector to increase or lower employment, it could then do that directly. If it needed to cool off speculation, it could do that directly. (That’s what law professor Saule Omarova, among others, have noted, and to thank her for her honesty, the Senate in 2021 killed her nomination to be an important bank regulator.)

During the New Deal era, the Fed didn’t have direct relationships with individuals or businesses, but an adjacent government bank, the Reconstruction Finance Corporation, as well as a postal bank, did. And the Fed did have much more granular control over a whole set of interest rates. The Fed could increase rates to commercial banks while lowering them to banks specializing in mortgages. As late as 1980, the Fed had the authority to set specific credit controls across the economy.

But today, we pretend that there is one interest rate set by a “market,” when in fact the Fed is constantly having to give benefits to the rich and well-connected to preserve this fiction. The truth is, money is a public system, organized by the government and run through government institutions we call banks. It just happens to be organized to benefit an oligarchy, which does not mean people who hold great private wealth, but a form of governance in which a few hold power by fusing the state’s power with their private estates.

That’s our system right now, and it’s called “Fed independence,” though I doubt you’ll read it in an Alito footnote.

And now, the rest of the monopoly round-up, after the paywall. Some fascinating stuff happened this week - there are rumors the Antitrust Division might settle the Ticketmaster antitrust suit, but Tennessee state attorney general Jonathan Skrmetti is going ahead regardless of what the the DOJ does. Plus, NASCAR settles its antitrust suit with sweeping changes, Trump issues an executive order in an attempt to bar state laws regulating AI, Apple’s app store monopoly takes a big hit in court, and the Trump Defense Department is trying to force all military officers to constantly use Google Gemini. Oh and incumbent Democrats are facing a wave of primary challengers, often on economically populist themes. Read on for more…